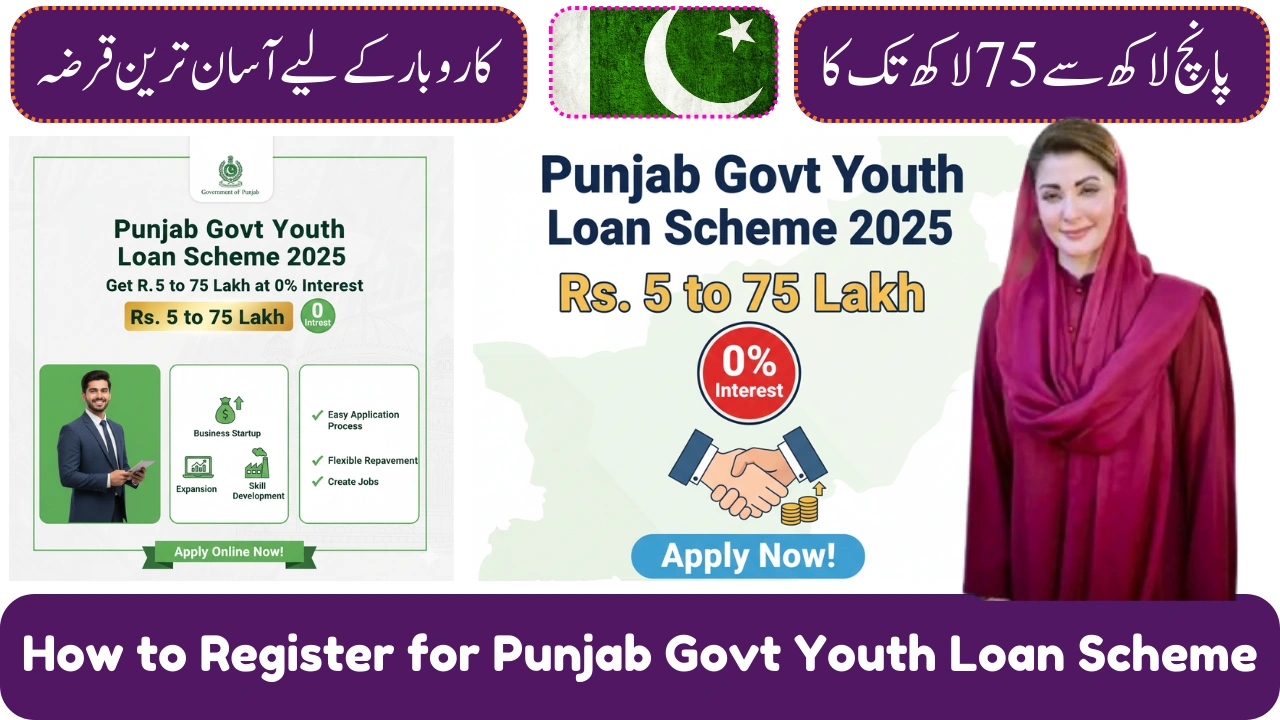

Punjab Govt Youth Loan Scheme 2025 – Get Rs. 5 to 75 Lakh at 0% Interest

The Punjab Government Youth Loan Scheme 2025 has been officially launched, giving young entrepreneurs a chance to secure funding between Rs. 5 lakh and Rs. 75 lakh at 0% interest. This initiative is designed to empower youth, reduce unemployment, and encourage new startups across the province.

If you are a student, job seeker, or aspiring entrepreneur, this guide will explain how you can apply, what documents you need, and who is eligible for the scheme.

What is Punjab Govt Youth Loan Scheme 2025?

The Punjab Youth Loan Scheme 2025 is part of the government’s vision to support young people financially. By offering interest-free loans, the scheme helps individuals start businesses, expand existing ones, or pursue innovative projects.

Key features of the scheme:

-

Loan amounts range from Rs. 500,000 to Rs. 7,500,000.

-

0% interest rate on repayments.

-

Flexible repayment periods with government support.

-

Priority for women, disabled youth, and graduates.

-

Accessible through online registration and designated banks.

This initiative not only provides financial support but also builds confidence among the youth to step into entrepreneurship.

Eligibility Criteria for Youth Loan Scheme 2025

Not every applicant qualifies automatically. To be eligible, you must:

-

Be a Pakistani citizen and resident of Punjab.

-

Be aged between 21 and 45 years.

-

Have a valid CNIC (Computerized National Identity Card).

-

Present a business plan or proposal for loan approval.

-

Not be a defaulter of any bank loan.

-

Students, graduates, women entrepreneurs, and skilled workers are strongly encouraged to apply.

Documents Required for Application

Applicants must submit valid documents for smooth processing of the loan application:

-

Original CNIC.

-

Recent passport-size photographs.

-

Educational certificates (if applying as a graduate).

-

Business plan with project details.

-

Bank statement or financial record (if available).

-

Utility bill or proof of residence.

All documents should be clear and up-to-date to avoid rejection.

How to Apply for Punjab Youth Loan Scheme 2025

Follow these steps to complete your registration successfully:

-

Visit the official Punjab Youth Loan Scheme portal.

-

Create an account using your CNIC and mobile number.

-

Fill in the online application form with personal and business details.

-

Upload scanned copies of required documents.

-

Submit your business plan for review.

-

Wait for verification and approval from the concerned bank.

-

Once approved, funds will be disbursed directly into your bank account.

📌 Important: There is no processing fee. Any agent asking for money is not part of the official scheme.

Benefits of Punjab Govt Youth Loan Scheme 2025

This loan program provides multiple benefits to young citizens:

-

Zero-interest repayment reduces financial pressure.

-

Opportunity to launch startups and small businesses.

-

Boosts employment opportunities in Punjab.

-

Supports women and marginalized groups.

-

Encourages innovation and skill development.

By removing financial barriers, the scheme is expected to create thousands of success stories across the province.

Frequently Asked Questions (FAQs)

1. What is the loan range in Punjab Youth Loan Scheme 2025?

Applicants can receive between Rs. 5 lakh and Rs. 75 lakh.

2. Is there any interest on this loan?

No, the scheme offers 0% interest on repayments.

3. Who can apply for the scheme?

Pakistani youth aged 21 to 45 residing in Punjab.

4. How can I apply?

Applications are submitted through the official online portal.

5. Do I need to provide collateral for the loan?

Collateral requirements depend on loan size, but most small loans are easily approved.

Conclusion

The Punjab Govt Youth Loan Scheme 2025 is a groundbreaking initiative for young entrepreneurs. With interest-free loans ranging from Rs. 5 to 75 lakh, this program gives the youth a golden chance to turn their business dreams into reality.

If you are eligible, don’t miss this opportunity—prepare your documents, register online, and submit your business plan today. With government support, your idea could become the next big success story in Pakistan.